Based on my conservative estimates, I think this value stock could be significantly mispriced by the market right now.

Multiple indicators have led me to the conclusion that there could be a 30% or more discount if I bought the shares right now.

Here’s my take on Michelmersh Brick Holdings (LSE:MBH).

What is it?

The company has five manufacturing plants and seven brands operating to manufacture and sell clay bricks and pavers. It also owns a landfill operator.

Most of its revenue comes from the UK, with the remaining 6.8% from Europe based on 2022 data.

What I like about it

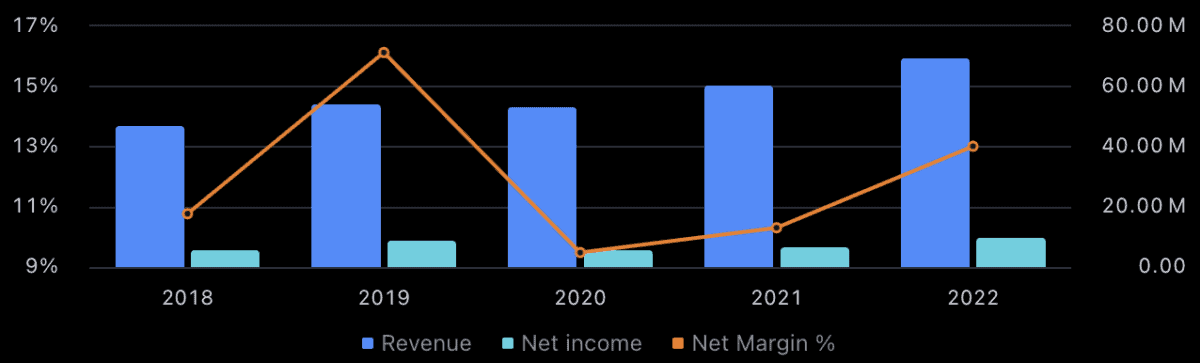

The firm has a net margin of 12%, which is really strong considering an industry median of 5%.

Additionally, a healthy 70% of its assets are balanced by equity. Such a stable balance sheet makes me confident in becoming a shareholder.

Also, its growing quite well. Over the last three years its average annual revenue growth rate was 7.5%. However, that’s only slightly higher than the industry median of 5.5%.

Selling at a 30% discount?

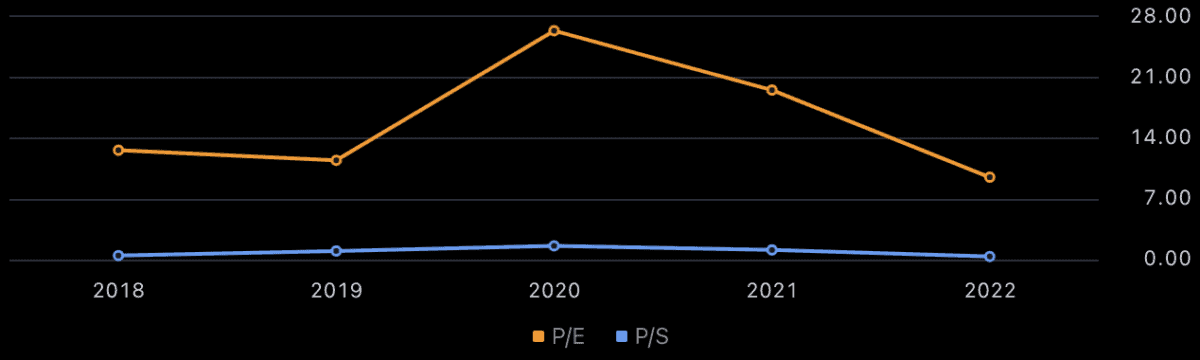

The shares have a price-to-earnings (P/E) ratio of around 9.5 based on future earnings estimates. That’s significantly cheap.

In fact, the shares are down nearly 40% from their all-time high:

Considering how the company’s earnings have recovered since the pandemic and its continued revenue growth, I think the investment should be selling at a higher price.

And the shares have been getting cheaper in relation to the firm’s earnings in the two years since the coronavirus crisis, now priced favourably at a similar level to before the event.

To get a more comprehensive view of the firm’s valuation, I projected the company’s net income forward for the next 10 years, estimating 7% growth per year on average.

My result, based on a method called discounted cash flow analysis, was a fair value for each share of around £1.45.

That means the investment could be priced at a 30% discount, as each share currently sells for about £1.

Risks if I invest

Now, although the company looks undervalued and could be selling at 30% off based on my estimate, there’s no guarantee it will earn my projected 7% every year.

I made my forecast incredibly conservative, but economic hardships, including another unexpected event similar to a pandemic, could wipe out my chances at a hefty profit.

Also, the firm is highly dependent on the housing market, so any changes to trends in the sector could affect the shares.

As an example, as the company specialises in clay bricks and products related to this, it could face a problem if consumer preferences change.

Bonus element

The firm’s valuation and financials are not the only things I love about the investment.

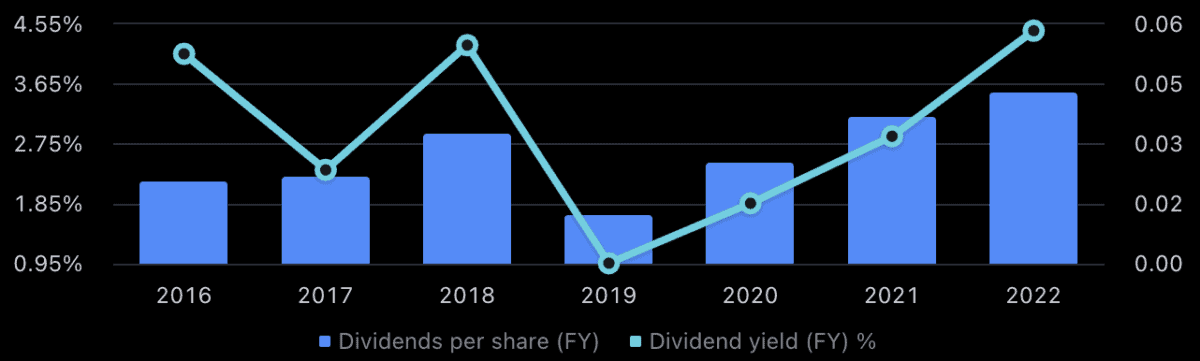

It also has a 4.4% dividend yield, paying out 46% of its earnings to shareholders to provide this.

It’s a buy for me

This company is at the top of my watchlist right now.

I’m planning on making a few investments in February, and this looks like it will be one of them.